Softbank, the giant Japanese investment group that has made huge bets on the sharing economy, is looking to cut its stake in Alibaba, according to reports. And possibly in Sprint too.

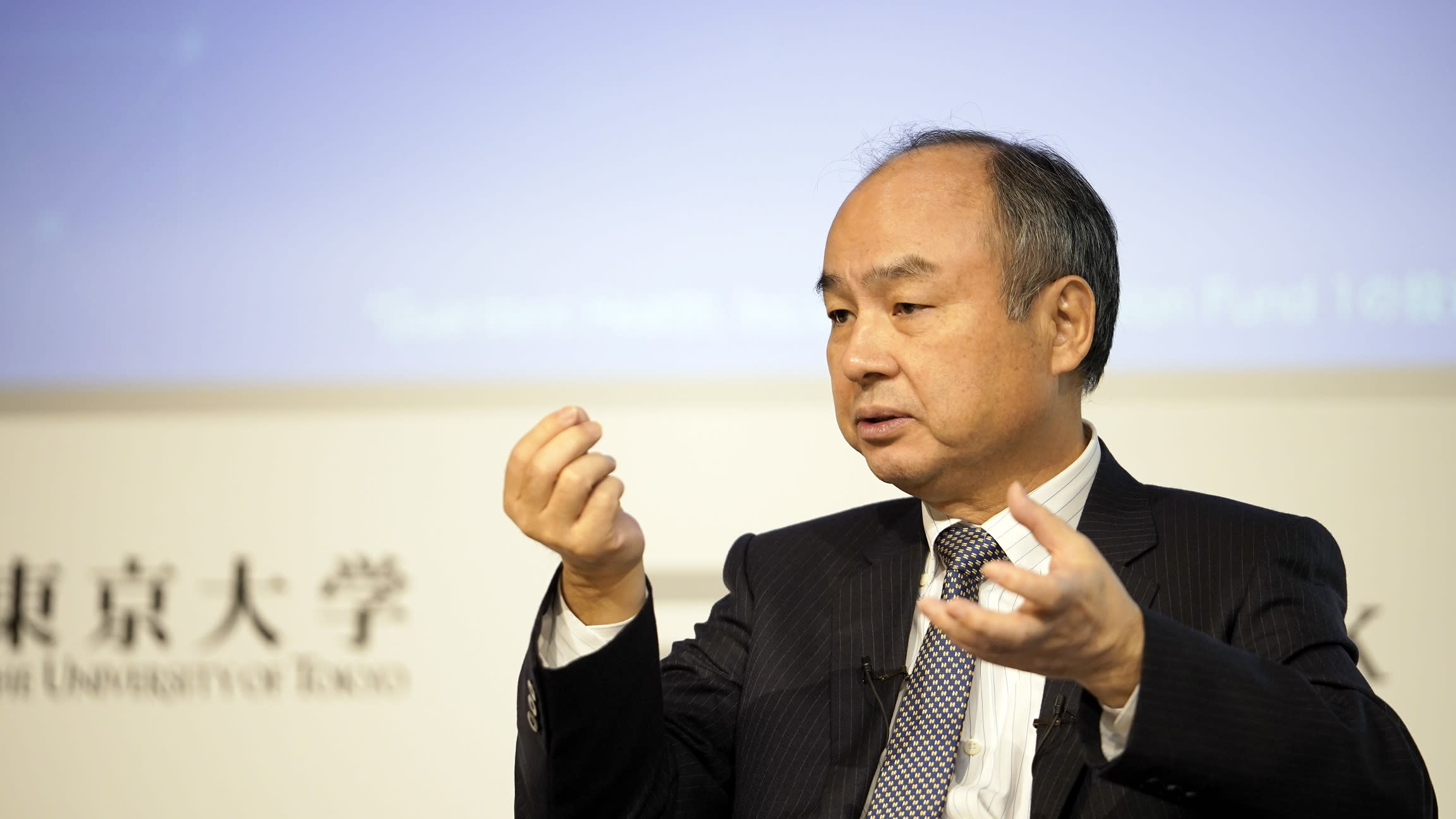

On Monday, Masayoshi Son, founder and CEO of the heavily indebted Softbank, said that he would raise or monetize $41 billion of assets, in order to put the group on a sounder financial footing. The company did not specify which assets are to be sold.

On Tuesday, Bloomberg reported that more than a third of the total would be raised by selling a $14 billion tranche of shares in Chinese e-commerce giant Alibaba. That would represent about 3% of Alibaba’s total equity capital, which is traded in New York in ADR form and, in a secondary listing, as shares in Hong Kong.

Softbank has long been an ally of Alibaba and has made vast paper profits on its 25% Alibaba holding. But the dire performance of Softbank’s other investments has depressed Softbank’s share price so much that at one point recently its holding in Alibaba was more valued more highly than the entire Tokyo-traded Softbank group.

News of the debt reduction plan lifted Softbank shares on Monday and pushed them by a further 18%, to JPY3,792 in Tuesday morning trade. Alibaba ADRs in New York dropped more than 2% to $176.34. By the Tuesday lunchtime trading halt in Hong Kong, the shares had risen 0.9% to HK$171.50.

Alibaba has been seen to be one of the better placed companies in China to survive the coronavirus crisis. It has a mix of online and retail shopping options, a large cloud computing business, China’s number three video streaming platform in Youku, and a large food delivery service that was loss-making prior to the virus-enforced lockdown of a large part of China’s population.

Softbank, in contrast has been criticized by investors for a series of poor bets, including Uber and office share company WeWork. Having previously held 84% of U.S. cellular phone company, Softbank saw its stake fall to 27%, following the merger of Sprint and T-Mobile. That allowed Softbank to deconsolidate Sprint and remove Sprint’s debt from its balance sheet.

More from Variety

"looking" - Google News

March 24, 2020 at 12:20PM

https://ift.tt/3bkgwnr

Softbank Looking to Cut Alibaba, Sprint Share Stakes (Report) - Yahoo Finance

"looking" - Google News

https://ift.tt/2tdCiJt

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Softbank Looking to Cut Alibaba, Sprint Share Stakes (Report) - Yahoo Finance"

Post a Comment