The top electric vehicle manufacturers reported strong vehicle deliveries in the third quarter.

Friday brought delivery numbers from EV pioneer Tesla Inc (NASDAQ: TSLA), and two of China's rising startups, Li Auto Inc. (NASDAQ: LI) and Nio Inc – ADR (NYSE: NIO).

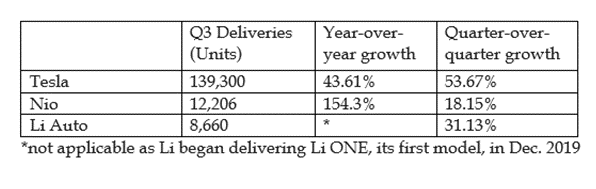

Given that Tesla doesn't break down monthly figures, here's how each of these companies fared in the quarter.

Strong Across-The-Board EV Delivery Growth: Reflecting the solid interest in EVs, each of the companies reported strong double-digit quarter-over-quarter growth.

Tesla sells globally, while Nio and Li's sales are confined to the Chinese market. It should also be noted that Tesla does not issue a geographic breakdown of delivery numbers.

Sequentially, Tesla's growth outdid that of its Chinese rivals.

Yet the strong increase should be taken with a pinch of salt. Pressured by factory shutdowns and the COVID-19 impact on consumers, Tesla's deliveries declined about 6.5% year-over-year in the second quarter.

Tesla's production stood at 145,036 units in the third quarter. China was a major source of strength this quarter, Wedbush analyst Daniel Ives said in a note.

At the same time, Nio began seeing a turnaround from the COVID-19 impact toward the end of the first quarter, which culminated in the Chinese company reporting record deliveries of 10,331 vehicles in the second quarter.

What's Next: Following the record third-quarter deliveries, Tesla remains on track to hit its 500,000-vehicle delivery goal for 2020, Ives said.

Model 3 demand in China has spiked, especially since Tesla began making the model at its Shanghai Giga.

The company is going all-out to ride the Model 3 momentum, and it recently cut the price of the standard range and long-range versions of this model.

The price cuts have produced the intended results, as reports suggest Model 3 demand has spiked in response.

For Nio, it has been an steady improvement. With the EC6 SUV that Nio began shipping last week, Nio's sales trajectory is only improving.

Nio's favorability with customers has been increasing, and this bodes well for the company, Deutsche Bank Securities analyst Edison Yu said in a recent note.

The analyst predicted record deliveries not only for the third quarter but also the fourth.

EV Price Action: Despite churning out record numbers, the shares of Tesla and Nio were lower in Friday's trading. The weakness is partly attributable to negative broader market sentiment.

At last check, Tesla shares were trading down 6.51% to $418.97 and Nio was shedding 1.98% to $21.33.

Li Auto shares were trading 1.01% higher at $16.97.

Related Links:

Tesla Analyst: China 'Star of the Show,' Automaker Set To Beat Q3 Delivery Forecast

Why Nio Has A Shot At Becoming The 'Tesla Of China'

Photo courtesy of Nio.

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Business - Latest - Google News

October 03, 2020 at 02:40AM

https://ift.tt/34dIPly

Tesla Vs. Nio Vs. Li Auto: How Q3 Deliveries From Electric Automakers Stack Up - Benzinga

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "Tesla Vs. Nio Vs. Li Auto: How Q3 Deliveries From Electric Automakers Stack Up - Benzinga"

Post a Comment