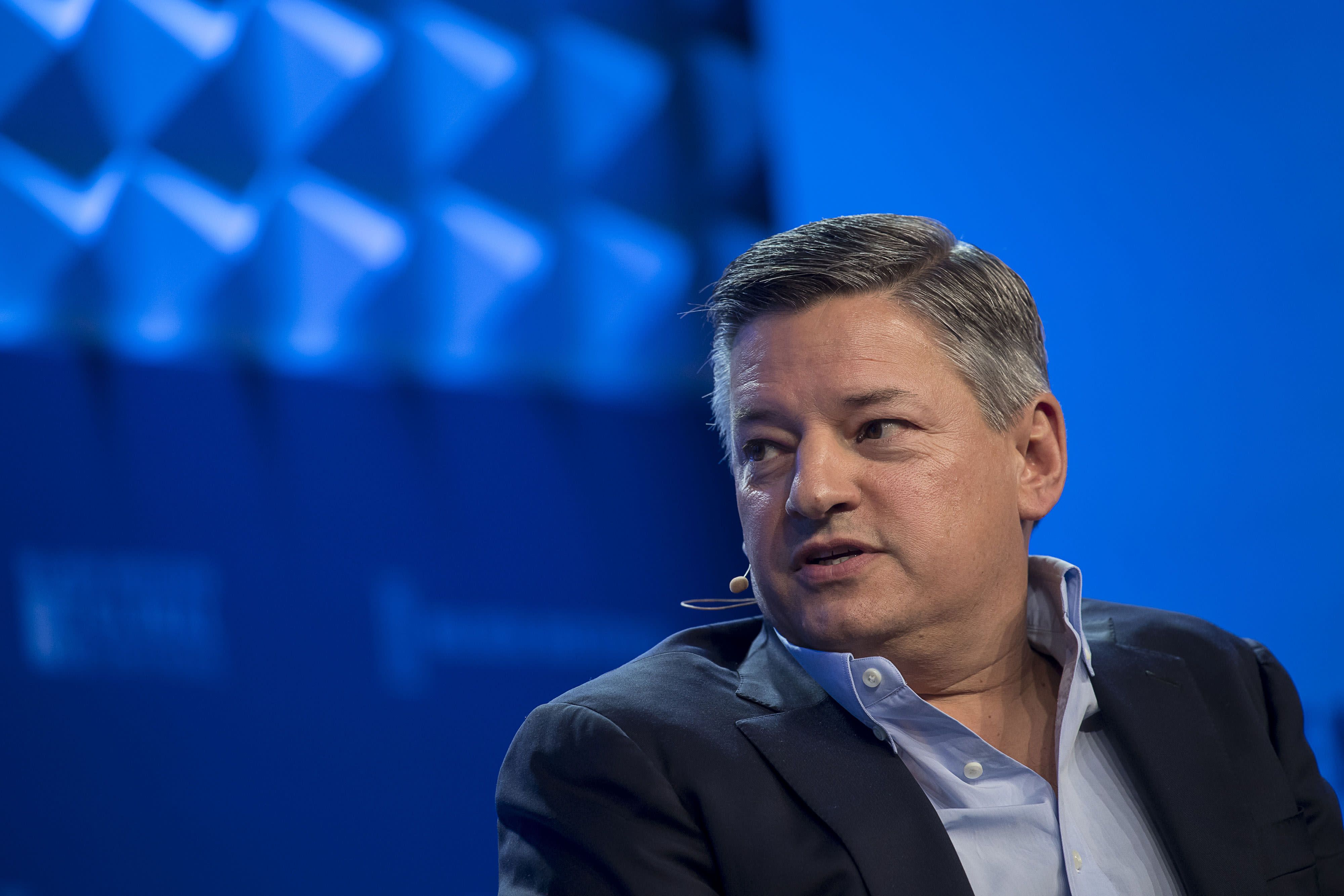

(Bloomberg) -- Ted Sarandos was just named co-chief executive officer at Netflix Inc. and already he faces a difficult task: soothing investor anxiety about slowing growth at the video-streaming giant.

The company tapped its longtime chief content officer to take the top job, alongside current CEO Reed Hastings, on a day when it delivered a disappointing subscriber forecast and sent its shares plunging as much as 15% in late trading. They recovered slightly, but were still down 7.3% in premarket trading in New York Friday.

The world’s largest paid streaming service expects to sign up 2.5 million new subscribers in the third quarter, compared with the more than 5 million expected on Wall Street.

That’s a steep comedown from Netflix’s ferocious growth in the first half of the year, when pandemic-fueled lockdowns sent consumers scrambling to sign up for the service. Netflix added 10.1 million new paid customers in the second quarter, beating Wall Street’s average estimate of 8.27 million. And the company finished the second quarter with almost 193 million subscribers.

Netflix warned in April that its growth would slow in the coming months, but investors were hoping to be pleasantly surprised. They bid up the company’s shares to record highs in recent weeks. The stock is up more than 60% for the year, vaulting Netflix’s market value past the likes of Walt Disney Co.

The change at the top was another curve ball for investors -- co-CEO arrangements often aren’t successful -- but Hastings and Sarandos have already worked together for decades and the title just made their existing partnership official, Netflix said.

Hastings, 59, has run Netflix from its Silicon Valley base in Los Gatos, California. The 55-year-old Sarandos, meanwhile, is more like the head of a studio, operating from Los Angeles.

The global pandemic has been a boon for Netflix, accelerating the shift toward online, on-demand TV and movies around the globe. With movie theaters, concert venues and sports arenas still closed to patrons in much of the world, people stuck at home have turned to Netflix and other streaming services for entertainment.

The company also scored big hits with original movies, including “Extraction” and “The Wrong Missy,” as well as reality TV shows “The Floor Is Lava” and “Too Hot to Handle.”

Yet the company has warned that the surge in new customers makes it harder to maintain that pace.

“When we think about the guidance for the third quarter, we’re not thinking about it just in itself,” Chief Financial Officer Spencer Neumann said on a call with analysts. “We just added 10 million members, which is the largest growth we’ve ever had in the second quarter.”

Production Schedule

Netflix also downplayed concerns that it will run out of new content soon. While production halted in almost every country due to the pandemic, Netflix has said it already has the programming it needs for this year and the first half of 2021.

The streaming service has released more than 30 movies since mid-March, and has had particular success with star-driven action films like “Extraction” and “The Old Guard.” “Extraction,” starring Chris Hemsworth, delivered the biggest audience of any Netflix original movie in its first four weeks.

“We want to have so many hits that you know when you come to Netflix, you can just go from hit to hit to hit, and never have to think about any of those other services,” Hastings said on the call.

The second quarter results were unusual in that the U.S. and Canada provided the largest boost in new customers. While that remains Netflix’s largest region, growth there has been slower of late because of how many people are already customers.

On a regional basis, the U.S.-Canada market led with 2.94 million new customers. Europe, the Middle East and Africa added 2.75 million, bringing the total there to 61.5 million. Netflix gained 2.66 million customers in Asia and 1.75 million in Latin America.

Second-quarter revenue rose to $6.15 billion, beating the average of analysts’ forecasts. But earnings of $1.59 a share fell short.

TikTok Threat

The company also faces plenty of competition. In addition to contending with new streaming services from Apple Inc., Disney, Comcast Corp.’s NBCUniversal and AT&T Inc.’s WarnerMedia, Netflix cited the TikTok video app as a rival on Thursday.

Netflix shares fell as low as $449.65 in after-market trading, putting an end to one of the biggest rallies of the year. The company’s valuation was almost $232 billion at the close of trading on Thursday.

(Updates with executive comments starting in 11th paragraph, premarket trading.)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Business - Latest - Google News

July 17, 2020 at 05:19PM

https://ift.tt/2DIMyxZ

Netflix Plunges on Tepid Outlook; Ted Sarandos Named Co-CEO - Yahoo Finance

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "Netflix Plunges on Tepid Outlook; Ted Sarandos Named Co-CEO - Yahoo Finance"

Post a Comment