US DOLLAR OUTLOOK: GBP/USD PRICE ACTION SURGES ON BREXIT DEAL CHATTER & STEERS DXY INDEX LOWER

- US Dollar edged lower on Wednesday as bulls and bears battle over the Greenback’s direction

- GBP/USD price action exploded over 130-pips higher on the session due to Brexit deal rumors

- The DXY Index could continue mirroring the Pound-Dollar as well as the VIX ‘fear-gauge’

The US Dollar declined broadly during Wednesday’s trading session as USD price action pivoted lower and unwound some of its recent gains. Sentiment-linked AUD/USD and NZD/USD ascended and were the top performing major currency pairs behind GBP/USD. The Pound Sterling, which makes up 11.9% of the DXY Index, surged over 130-pips on the day in response to news of a Brexit deal emerging.

Recommended by Rich Dvorak

Forex for Beginners

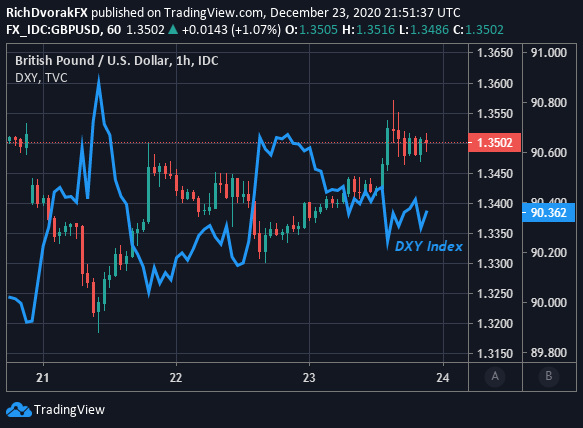

GBP/USD PRICE CHART WITH US DOLLAR INDEX OVERLAID: 1-HOUR TIME FRAME (18 DEC TO 23 DEC 2020)

Chart by @RichDvorakFX created using TradingView

With Brexit deal chatter driving GBP/USD higher and EUR/USD price action piggybacking on Pound Sterling strength, there could be potential for a return of broad US Dollar weakness and invalidation of the recent US Dollar rebound attempt. This development, combined with talks of US politicians potentially boosting coronavirus aid checks to $2,000 from the initially agreed upon $600 amount, likely invigorated trader risk appetite and steered the US Dollar lower with the S&P 500-derived VIX Index. Need for fiscal stimulus was underscored by soft US economic data released earlier in the session.

| Change in | Longs | Shorts | OI |

| Daily | 40% | 11% | 25% |

| Weekly | 67% | -14% | 17% |

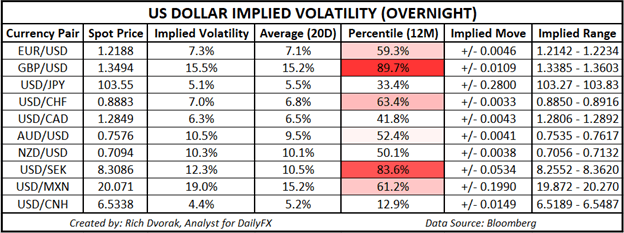

USD PRICE OUTLOOK - US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Learn more about implied volatility trading strategies!

US Dollar implied volatility readings have cooled off a bit judging by the overnight tenor. This is to be expected headed into Thursday’s trading session, however, in light calm market conditions typically observed around holidays. Shortened hours on Thursday in observation of Christmas might result in relatively low volume and liquidity. GBP/USD is expected to be the most active major currency pair and USD/MXN is expected to be the most active minor currency pair with overnight implied volatility readings of 15.% and 19.0% respectively.

Keep Reading - Top 10 Most Volatile Currency Pairs and How to Trade Them

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

Business - Latest - Google News

December 24, 2020 at 06:00AM

https://ift.tt/34FSPFx

USD Price Outlook: US Dollar Back on Defense as Brexit Weighs - DailyFX

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "USD Price Outlook: US Dollar Back on Defense as Brexit Weighs - DailyFX"

Post a Comment