Last August, when the Federal Reserve was in the middle of the most aggressive interest-rate-hiking campaign in decades to bring down the highest inflation in decades, Federal Reserve Chair Jerome Powell warned its efforts would “bring some pain” to households and businesses.

That pain may begin bearing down on the economy soon.

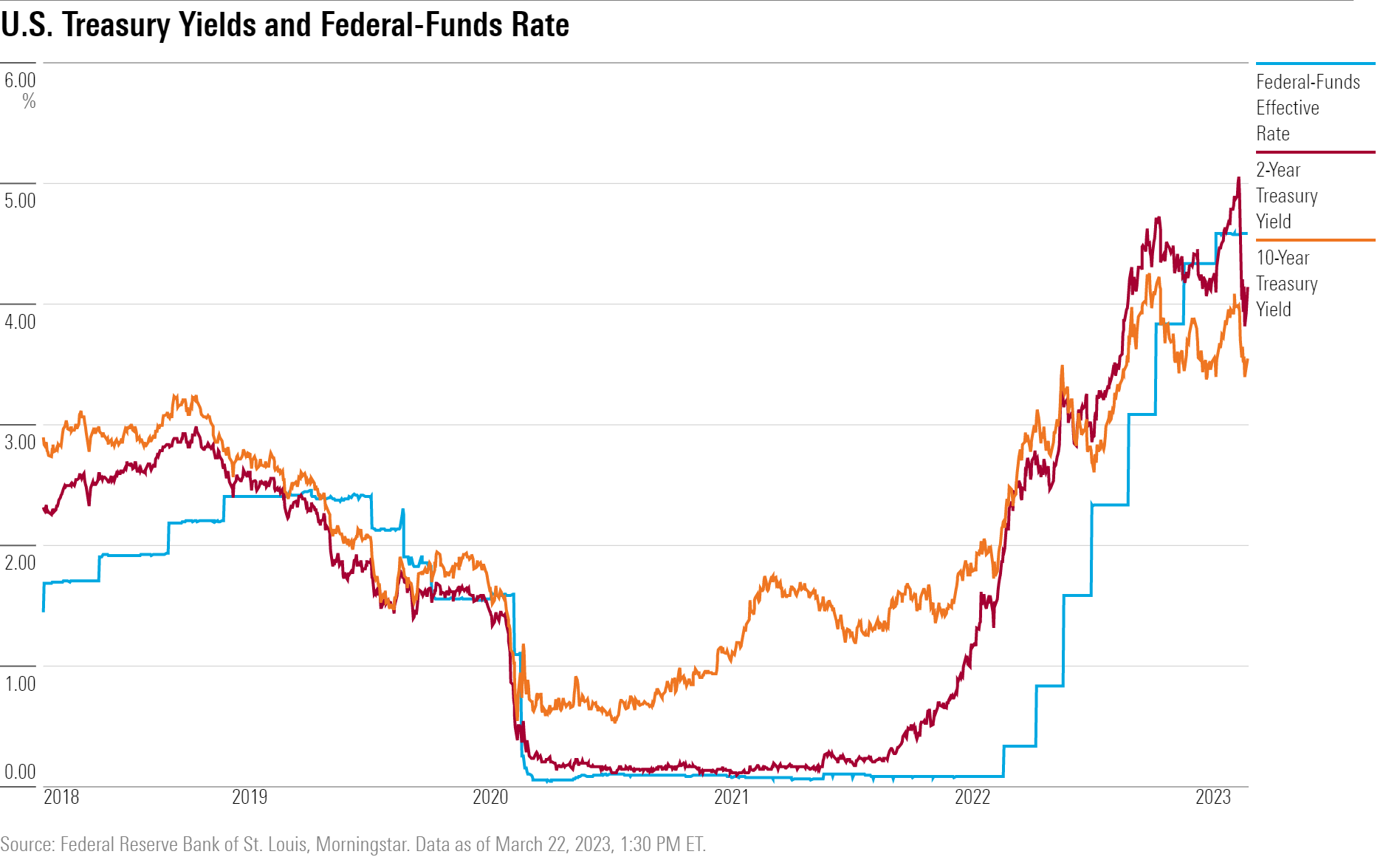

By pushing ahead with its ninth straight increase in the federal-funds rate Wednesday, lifting it by 0.25 percentage points to a target range of 4.75%-5%, U.S. central bankers signaled inflation remains their top priority, despite a banking crisis that has roiled the financial markets the past two weeks. They also tipped the scales toward a more painful outcome for the economy as tighter credit conditions kick in and likely crimp consumer confidence and spending.

Tighter credit conditions played a role in the Fed’s decision to raise rates by a more moderate pace than it had anticipated just a few weeks before.

James Ragan, director of wealth management research at D.A. Davidson, thought a pause would’ve been appropriate at this point in the cycle and especially amid a banking crisis that is still playing out.

“We’re cautious here,” says Ragan. “There was a banking crisis that came out of nowhere. Could there be other looming problems out there? The odds of a recession have increased. Earnings estimates are more at risk.”

Among the signs for investors to watch for:

- Consumer confidence shaken by banking crisis and tighter credit;

- Falloff in consumer spending;

- Bank woes spreading to commercial real estate.

Fed’s Continued Inflation Fight

At the press conference following the March 22 meeting, Powell revealed that the rate-setting committee had considered a pause in the aftermath of the banking crisis. However, he said the rate increase was “supported by a strong consensus” and that the Fed is strongly committed to bringing inflation to the 2% level.

In making its move, the Fed noted its biggest economic worry continues to be elevated inflation despite the turmoil in the banking system in the past two weeks, during which two regional banks failed, another teetered on collapse, and a major bank needed rescuing. Powell declared the banking system to be “sound and resilient.”

“Inflation remains too high, and the job market remains too tight,” said Powell, defending the increase. “The process of getting inflation down has a long way to go and is likely to be bumpy.”

Yet, the impacts from the banking crisis will ripple widely through the economy, as banks get stingier with credit.

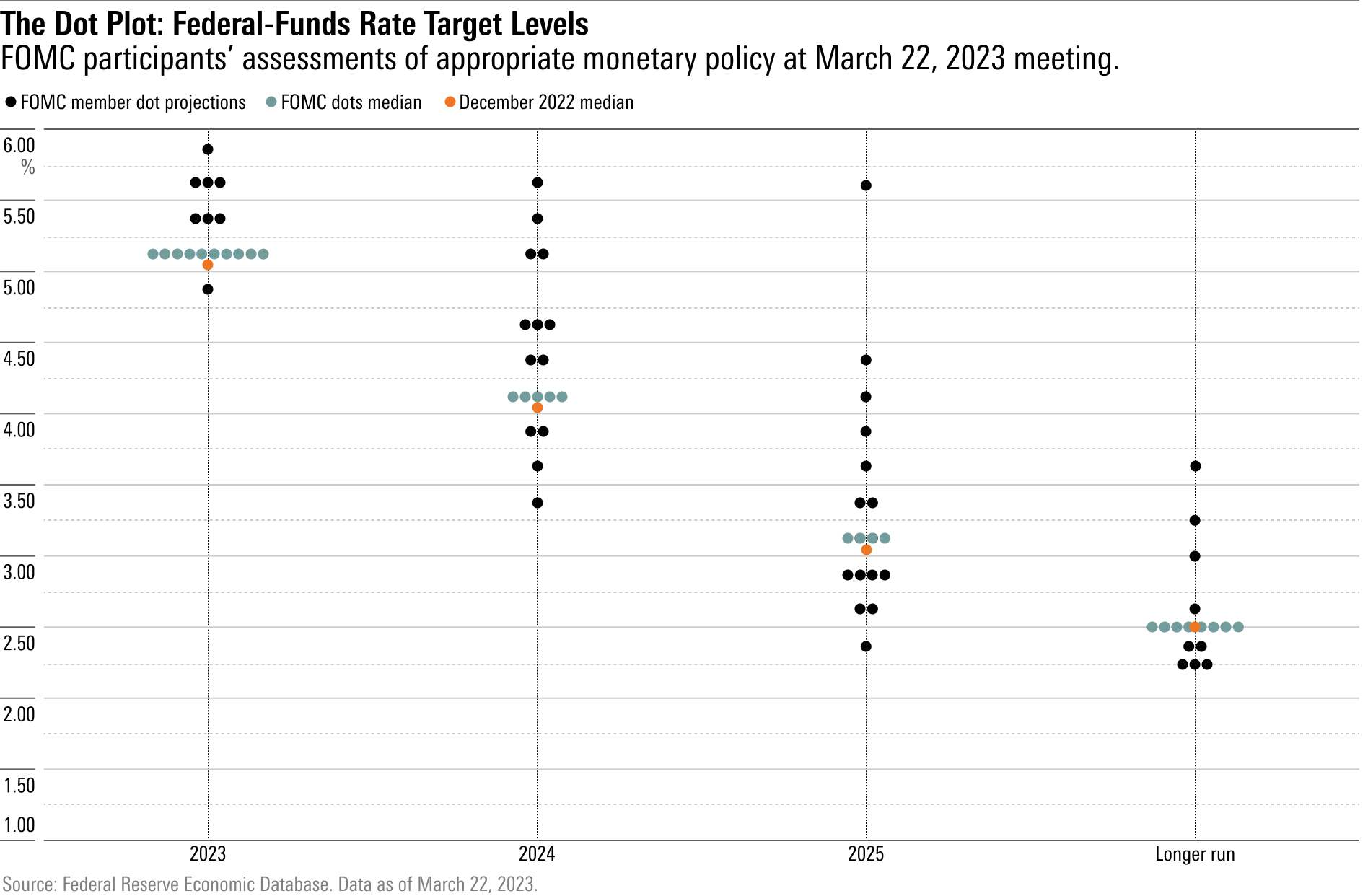

Powell said “ongoing” rate increases are no longer projected but that “some policy firming” may be necessary in the future based on economic data and financial conditions. Its current forecast put the fed-funds rate at 5.1% at year-end 2023, suggesting one more hike is in the cards.

Powell explained that the move away from “ongoing” interest-rate increases reflected the expected impact of the banking crisis. Tighter credit conditions will serve as the “equivalent of a rate hike,” and “weigh on economic activity, hiring, and inflation.” That expectation played a role in the Fed’s decision to raise rates by a more moderate pace than it had anticipated just a few weeks before.

Its ongoing program to reduce its holdings of Treasury securities and mortgage-backed securities on its balance sheet, a process known as “quantitative tightening,” is also designed to essentially move rates higher.

Is a Recession More Likely Now?

The central question facing investors is what the combination of high interest rates and a potential credit crunch will mean for an economy that, through February at least, had been chugging along.

“The question is how significant will this credit tightening be and how sustained will it be,” Powell said. That’s the issue.”

Powell held out hope for a so-called soft landing, in which economic activity slows meaningfully but a recession is avoided. He conceded the outlook was uncertain.

“It’s too early to say if a soft landing can be achieved,” he said. “There is a pathway, the pathway still exists and we’re trying to find it.”

Last August, Powell said that “while higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

The economy has proved resistant to the Fed’s series of rate hikes with the labor market strong and unemployment at 50-year lows. Prices in the services sector remain high, as well.

The Fed sees real gross domestic product growth slowing to 0.4% this year from 0.9% in 2022. It sees a slight pickup to 1.2% in 2024. It puts the unemployment rate at 4.5% this year and 4.6% in 2024.

“The 2023 unemployment projection of 4.5% is well above today’s prevailing 3.6%, suggesting a tangible deterioration in employment conditions as the year wears on,” Rick Rieder, BlackRock’s chief investment officer of global fixed income, noted in commentary after the meeting.

Will the Fed Cut Interest Rates in 2023?

In the bond futures market, where investors place bets on the direction of interest rates, the outlook has shifted dramatically. According to the CME FedWatch tool, traders see a nearly 50% chance the Fed will cut rates by the September policy-setting meeting, and a roughly 68% chance that the Fed will cut interest rates by the conclusion of the November meeting.

However, the Fed stuck closely to its outlook for interest rates.

The Fed’s projections for the fed-funds rate from 2023 through 2025 remain about the same as it forecast in December: 5.1% in 2023, 4.3% in 2024, up slightly from 4.1%, and 3.1% in 2025.

“It’s striking how little their forecasts have changed given how much has changed,” says Eric Winograd, U.S. chief economist at AllianceBernstein. “The Fed is telling us they are cautiously optimistic. They feel comfortable about the health of the banking system and that’s good news. They also think tightening credit conditions from the distress in the banking system will also help them achieve their inflation goals.”

“I think they did the right thing,” said Dec Mullarkey, managing director of investment strategy and asset allocation at SLC Management, a unit of Sun Life Financial. “They sent a powerful message about the soundness of the financial system. It would take a lot to derail them from their inflation fight.”

Fed chair Powell characterized the recent banking crisis as an “isolated” event involving a “small number of banks” rather than systemwide. He blamed the collapse of Silicon Valley Bank SIVB on management, saying it had “failed badly” and that the bank was an “outlier.”

Still, he admitted supervisory lapses on the part of regulators also contributed to the problems.

“We do need to strengthen supervision and regulation,” he said, suggesting, too, that regulations had not kept pace with technology. “The speed of the run [on bank deposits] was very different than what was seen in the past,” he said.

Morningstar’s chief U.S. economist Preston Caldwell is among those who think the economy can weather the banking system’s struggles. “We also don’t take it as a given that bank troubles will massively weigh on economic growth,” he wrote Wednesday following the Fed meeting. “Hundreds of banks—albeit mostly very small ones—failed per year in the latter half of the 1980s, yet neither a financial crisis nor a recession occurred. Not every bank failure is a harbinger of a 2008-style collapse in the financial system.”

Powell also downplayed concerns that commercial real estate loans pose a risk to regional banks, saying it wasn’t analogous or comparable to the problems that led to the failures of Silicon Valley Bank or Signature Bank SBNY.

Yet, Mullarkey of SLC is watching the commercial real estate loan market closely as regional banks are responsible for 80% of lending to that industry.

“I was very surprised he minimized the commercial mortgage risk,” he says. “It’s a big risk.”

Business - Latest - Google News

March 24, 2023 at 01:04AM

https://ift.tt/mfvB1TL

Are We About to Feel the Economic Pain Powell Warned Would Be Coming? - Morningstar

Business - Latest - Google News

https://ift.tt/DLebCqS

Bagikan Berita Ini

0 Response to "Are We About to Feel the Economic Pain Powell Warned Would Be Coming? - Morningstar"

Post a Comment