Warren Buffett on Saturday lamented the lack of attractive investments available to his sprawling $713bn Berkshire Hathaway conglomerate, warning that low interest rates over the past two years had inflated valuations across financial markets.

The musings, in Buffett’s long-anticipated annual letter, accompanied results that showed Berkshire’s operating profits had soared 45 per cent from a year before to $7.3bn in the final three months of the year. The gains were propelled by strong results from its BNSF Railway and the string of electric utilities it owns.

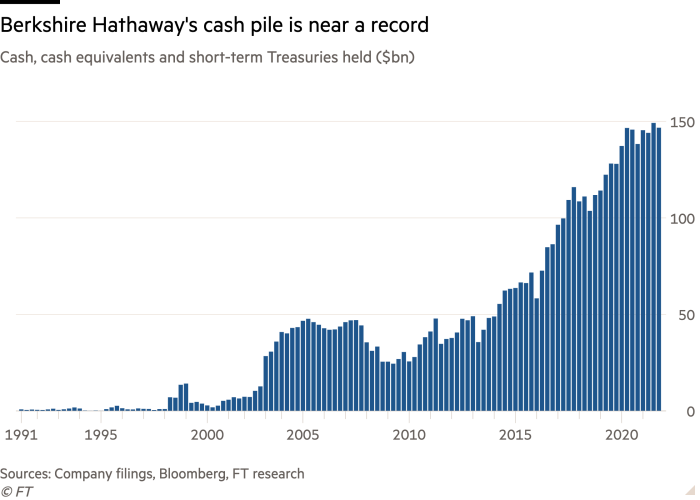

Buffett, 91, told Berkshire investors that both he and his longtime right-hand man Charlie Munger had found “little that excites us” as they sought out investments with which to plough some of the group’s gargantuan $146.7bn cash pile into.

“Charlie and I have endured similar cash-heavy positions from time to time in the past,” he said. “These periods are never pleasant; they are also never permanent. And, fortunately, we have had a mildly attractive alternative during 2020 and 2021 for deploying capital.”

Buffett, who has been criticised for not using more of the company’s available cash to buy up companies to add to its portfolio, has instead turned heavily to buying back Berkshire stock. The company spent $27.1bn on share repurchases last year, and Buffett noted in his letter that it had already bought a further $1.2bn of Berkshire stock in 2022.

The view from the doyen of the investment industry comes after a turbulent three months in financial markets, with investors dumping the shares of lossmaking companies as they race out of riskier corners of the stock market.

“Speaking less politely, I would say that bull markets breed bloviated bull,” Buffett said, before trailing off.

The moves in the stock market have been spurred largely by a shift from the Federal Reserve, which is readying to raise interest rates for the first time since 2018 as it works to tame inflation and curb excesses it sees in markets.

“Long-term interest rates that are low push the prices of all productive investments upward, whether these are stocks, apartments, farms, oil wells, whatever,” Buffett wrote. “Other factors influence valuations as well, but interest rates will always be important.”

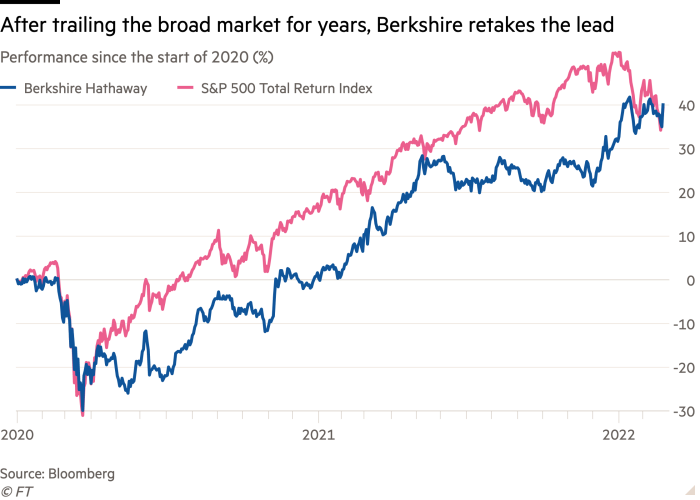

Conditions in the market have started to favour old-line industrial conglomerates, financial behemoths, energy giants and utilities — all Berkshire business lines. The company’s stock has advanced 6.4 per cent so far this year, far ahead of the 8 per cent slide by the S&P 500.

Many of the excesses that Buffett and Munger have warned about in recent years have started to seep out of the market. The average company in the Russell 3000, which captures both large and small US businesses, is down more than 30 per cent from their 52-week highs, Financial Times calculations show.

Data from Finra, Wall Street’s watchdog, also signal that some of the speculation that dominated trading activity in 2021 has been washed out. The amount of borrowed money being used to fund stock positions has dropped by more than a tenth since October.

“People who are comfortable with their investments will, on average, achieve better results than those who are motivated by ever-changing headlines, chatter and promises,” Buffett said.

The long-term strategy pitched by Buffett has attracted legions of devotees over the years, who read his annual letter both for investment advice and to hear his take on world events.

The company’s annual report, also released on Saturday, showed that the company added few new positions to its $351bn stock portfolio and instead was a net seller of equities. Berkshire spent $8.4bn in 2021 buying stocks. By contrast it sold shares worth $15.8bn.

Berkshire’s many operating companies, which include ice cream purveyor Dairy Queen, the Geico insurer, and private jets operator NetJets, nonetheless had a banner year.

Full-year net income more than doubled from a year prior to $89.8bn, or $59,460 per class A share, a result that included a large gain on the rise in value of its stock holdings. Buffett has long said that the total profit figure Berkshire must report, which is effected by fluctuations in the stock market, is generally “meaningless”.

He has instead focused on operating profits generated by individual divisions of the company. BNSF reported a 16 per cent jump in earnings to nearly $6bn, propelled by higher shipments of consumer and industrial goods and coal through its railroad. Revenues at the unit, which Buffett described in his letter as Berkshire’s “most important acquisition”, nearly returned to pre-pandemic levels.

The company’s results are often seen as a barometer of the broader US economy, given the hundreds of subsidiaries it has that operate in far-flung industries. Sales at its utilities rose, as well as at its manufacturing, retail and home building businesses.

Buffett also offered space in the annual report for Greg Abel, the person the board has anointed as his eventual successor, to detail how Berkshire planned to tackle sustainability at the group. The company this year listed climate change as a risk factor for its business.

Abel said the effort was focused on Berkshire Hathaway Energy, where the company is investing in solar and wind projects, and BNSF.

Business - Latest - Google News

February 27, 2022 at 01:32AM

https://ift.tt/i9p7oD6

Berkshire Hathaway profits soar but Warren Buffett bemoans lack of good deals - Financial Times

Business - Latest - Google News

https://ift.tt/YfAylCh

Bagikan Berita Ini

0 Response to "Berkshire Hathaway profits soar but Warren Buffett bemoans lack of good deals - Financial Times"

Post a Comment