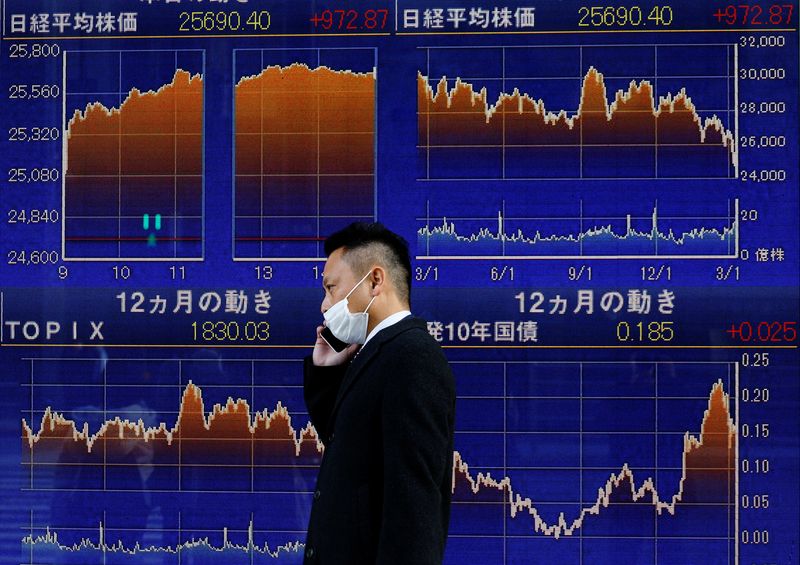

© Reuters. A man wearing a protective mask, amid the coronavirus disease (COVID-19) outbreak, walks past an electronic board displaying graphs (top) of Nikkei index outside a brokerage in Tokyo, Japan, March 10, 2022. REUTERS/Kim Kyung-Hoon 2/2

© Reuters. A man wearing a protective mask, amid the coronavirus disease (COVID-19) outbreak, walks past an electronic board displaying graphs (top) of Nikkei index outside a brokerage in Tokyo, Japan, March 10, 2022. REUTERS/Kim Kyung-Hoon 2/2By Elizabeth Dilts Marshall

NEW YORK (Reuters) - World shares rose on Thursday and the U.S. dollar edged lower, a day after minutes from the U.S. Federal Reserve's May meeting indicated the central bank would remain flexible and might pause rate hikes later in the year.

Wall Street closed higher with the three main U.S. indices positioned for their biggest weekly gains since mid-March.

The MSCI's benchmark for global stocks was up 1.54% at 4:25 p.m. EDT (2025 GMT). Europe's pan-regional equity benchmark index rose 0.78%, while the MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.02%.

The .DJI rose 516.91 points, or 1.61%, to 32,637.19; the .SPX gained 79.11 points, or 1.99%, to 4,057.84; and the .IXIC added 305.91 points, or 2.68%, to 11,740.65.

The three indexes were on track to snap their longest streak in decades of weekly declines.

The minutes of the Fed's May meeting, released on Wednesday, showed a majority of Fed officials supported the well-telegraphed rate hikes of 50 basis points each in June and July.

Analysts at Bank of America (NYSE:) said the Fed could pause its tightening in September if the economy deteriorates.

Data on Thursday showed the number of Americans filing new claims for unemployment benefits fell more than expected last week as the labor market remained tight. A separate report confirmed the U.S. economy contracted in the first quarter.

"Jobs data is really going to drive the outlook of the Fed going forward," said Brian Overby, a senior options analyst at Ally. "If they do see the unemployment rate increase a little bit that could slow them down."

The U.S. dollar fell 0.284% against a basket of global currencies. If the Fed gets less aggressive on tightening, that would weaken the greenback's safe-haven appeal.

The euro was up 0.44% to $1.0727.

U.S. Treasury yields edged up after the benchmark 10-year note hit a six-week low, with signs of slower economic growth reducing inflation fears.

The yield on rose 2.7416% after falling to 2.706% early in the session.

"The 10-year treasury was almost at 3% and has pulled back,” said Clark Kendall, president and CEO of Kendall Capital. "That is an indication that the market feels like the Fed is addressing the inflation problem."

In commodities, futures rose $3.37, or 3.0%, to settle at $117.40 a barrel, while U.S. West Texas Intermediate (WTI) crude rose $3.76, or 3.4%, to settle at $114.09.

U.S. was last up 0.17% to $1,849.50.

In Asia, Chinese blue chips reversed earlier losses to rise 0.25% after struggling to find direction for most of the session, as investors fretted over signs of a slowdown but took comfort in comments from Premier Li Keqiang on stabilizing the ailing economy.

South Korea's central bank raised interest rates for a second consecutive meeting as it grapples with consumer inflation at 13-year highs.

Business - Latest - Google News

May 27, 2022 at 03:01AM

https://ift.tt/y7fQP4s

Global shares rally on relief after Fed minutes By Reuters - Investing.com

Business - Latest - Google News

https://ift.tt/rSvsMNa

Bagikan Berita Ini

0 Response to "Global shares rally on relief after Fed minutes By Reuters - Investing.com"

Post a Comment