(Bloomberg) -- European stocks and US equity-index futures fluctuated within short ranges amid concern the Federal Reserve will keep borrowing costs higher for longer. Optimism over China’s economic recovery that drove a rally in Asia fizzled.

Most Read from Bloomberg

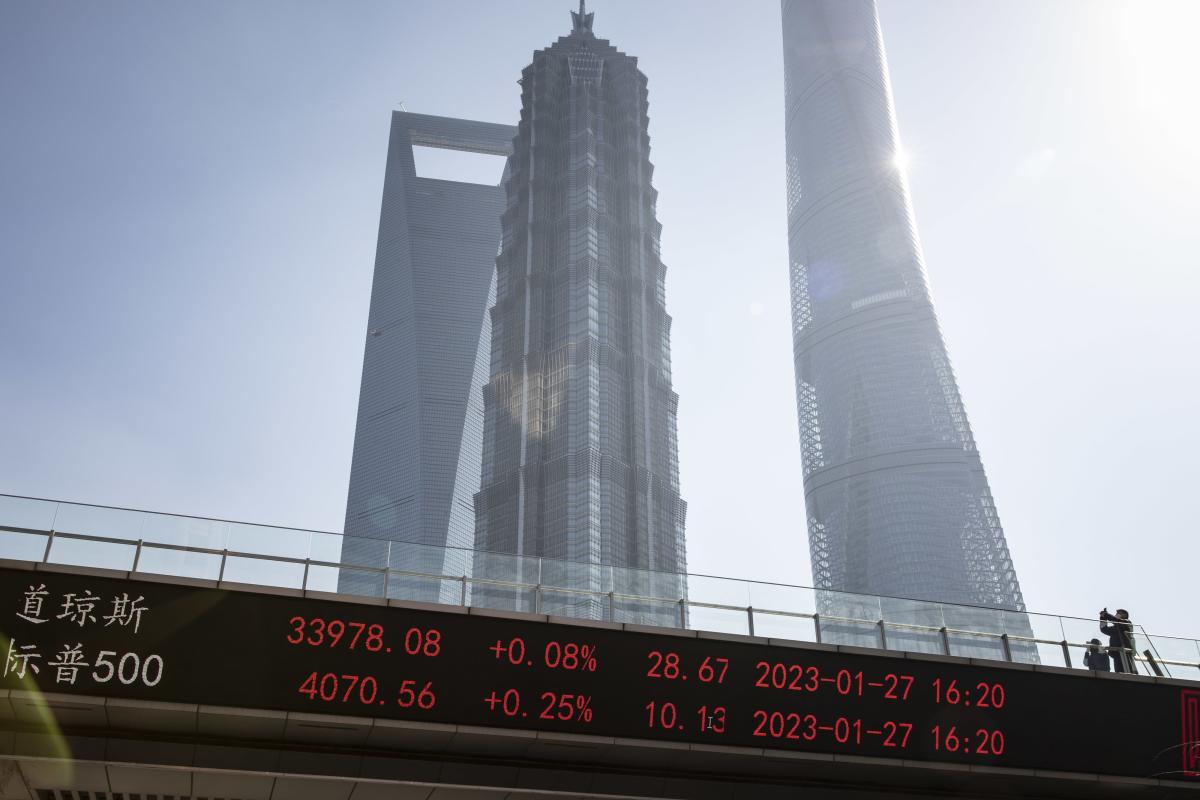

The Stoxx Europe 600 Index traded marginally higher after rising as much as 0.3% and falling as much as 0.2%. The Shanghai Composite Index earlier climbed the most since November. Treasury futures were lower as investors assessed hawkish comments by Federal Reserve officials. The dollar took a breather from a three-week rally. Trading volumes were thin amid a US holiday, making directional changes more frequent.

A chorus of investors including Goldman Sachs Group Inc. is betting on Chinese equities to resume a rally as the world’s second-biggest economy deepens stimulus and relaxes pandemic restrictions. While this has sparked inflows into global assets tied to the Chinese economy, the broader sentiment in markets remains impaired, with the Fed resolute on its fight against inflation. Growing geopolitical tensions are also preventing investors from turning more bullish.

“The only place where the central bank will remain soft enough is China, to recover from a series of absurd Covid measures that pushed the economy into an unnecessary depressed zone,” Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, wrote in a note. “The geopolitical tensions aren’t going in the right direction for restoring confidence.”

Europe’s Stoxx 600 was dragged by consumer and technology stocks, even as the gauge’s commodity names rallied. In China, stocks gained after a Goldman report that penciled in a rebound on the back of an earnings recovery. Calls for further stimulus via lower rates also built up, prompting the nation’s banks to keep their lending rates unchanged.

Contracts on the S&P 500 and Nasdaq 100 indexes were little changed, with Treasury futures dropping across the curve. Stocks ended last week on a muted note after Richmond Fed President Thomas Barkin and Fed Governor Michelle Bowman both expressed their support for continued rate hikes. That followed hawkish remarks by St. Louis Fed President James Bullard and Cleveland President Loretta.

Given the holiday absence of US traders, it was unclear how the markets viewed the flurry of geopolitical developments over the past few days. First, the weekend underscored growing tensions between the world’s two superpowers: US Secretary of State Antony Blinken and China’s State Councilor Wang Yi traded barbs on everything from Taiwan to North Korea and Russia in their first meeting since a spy balloon controversy. Then, North Korea fired a barrage of suspected ballistic missiles and issued a warning to the US over joint military exercises.

On Monday, US President Joe Biden made a surprise visit to Kyiv and met with his Ukrainian counterpart Volodymyr Zelenskiy, declaring “unwavering support” in a show of solidarity as Russia’s invasion nears the one-year mark.

Oil futures advanced on Monday. Demand from China will climb by 800,000 barrels a day in 2023, according to the median estimate of 11 China-focused consultants surveyed by Bloomberg News. That would take consumption to an all-time high of about 16 million barrels a day, the survey showed.

Investors also awaited clues on US consumer demand as Walmart Inc. and Home Depot Inc. were set to kick off a slew of retail earnings reports this week.

Key events this week:

-

Earnings for the week are scheduled to include: Alibaba, Anglo American, AXA, BAE Systems, Baidu, BASF, BHP, Danone, Deutsche Telekom, Holcim, Home Depot, Hong Kong Exchanges & Clearing, HSBC, Iberdrola, Lloyds Banking Group, Moderna, Munich Re, Newmont, Nvidia, Rio Tinto, Walmart, Warner Bros Discovery

-

US financial markets closed for Presidents’ Day holiday, Monday

-

PMIs for Japan, Eurozone, UK, US, Tuesday

-

US existing home sales, Tuesday

-

US MBA mortgage applications, Wednesday

-

The Federal Reserve minutes from Jan. 31-Feb. 1 policy meeting, Wednesday

-

Eurozone CPI, Thursday

-

US GDP, initial jobless claims, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

G-20 finance ministers and central bank governors meet in India, Thursday-Friday

-

Japan CPI, Friday

-

BOJ governor-nominee Kazuo Ueda appears before Japan’s lower house, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.1% as of 1:13 p.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures rose 0.1%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The MSCI Asia Pacific Index rose 0.6%

-

The MSCI Emerging Markets Index rose 0.5%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.2% to $1.0675

-

The Japanese yen was little changed at 134.03 per dollar

-

The offshore yuan rose 0.2% to 6.8619 per dollar

-

The British pound was little changed at $1.2029

Cryptocurrencies

-

Bitcoin rose 1.3% to $24,862.61

-

Ether rose 1.5% to $1,711.08

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Tassia Sipahutar and Akshay Chinchalkar.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Business - Latest - Google News

February 20, 2023 at 08:16PM

https://ift.tt/v8zsBXx

Stocks Wobble as China Bets Fade; Dollar Stalls: Markets Wrap - Yahoo Finance

Business - Latest - Google News

https://ift.tt/zknphJD

Bagikan Berita Ini

0 Response to "Stocks Wobble as China Bets Fade; Dollar Stalls: Markets Wrap - Yahoo Finance"

Post a Comment